August Market Minute

- Aug 14, 2023

- 4 min read

August Market Minute

Discombobulated Economy

If you Find the Economy Confusing, Don’t Worry: It Is. Contradictory economic gauges are telling different stories, standard leading indicators are in question, and markets appear to be prepping for both boom and bust, (WSJ, 7/14). Bond markets are expecting a ‘recession’ while equity markets are climbing higher in anticipation of a ‘soft landing’ and continued economic growth. The steeply inverted yield curve is one measure of the bond markets ‘recession’ expectation, meanwhile the S&P 500 has rallied almost 20% year-to-date is an example of the continued optimism of equity markets.

The divergence can be seen in economic data too. The split between the ISM Service Sector Index, bouncing upward and the ISM Manufacturing Sector Index below 50, indicating contraction. For example: the housing market is also proving to be more robust than anticipated even as mortgage rates have tripled over the last 18-months. US economic growth has remained stronger than expected with Q2 growth coming in at 2.4% To add to the confusion central banks raised interest rates further in July but are stopping short of giving any ‘forward guidance’ to what the next meeting will bring.

Our view is that with headline inflation rates coming down and signs of the labour market cooling that the Fed and Bank of Canada will hold for the next couple of meetings. Sorting through all the indicators our view is that the effects from the higher rates have not fully worked through the economy and that a recession is still a high probability. Even past recessions have lagged indicators, such as an inverted yield curve, by many months and this time there is also the unknown factor of how much the extra stimulus cheques to households will continue to help support the economy. However, with headline inflation declining central banks will be quicker to ease policy rates to help combat a recession, which will lessen the effects.

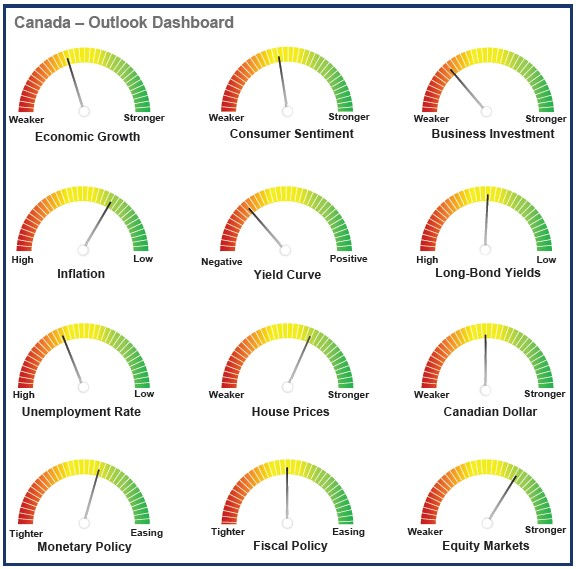

Canada Outlook

The Outlook Dashboard provides a snapshot of our outlook for the Canadian economy over the next 3 to 6 months. Our outlook has not changed significantly from June. Economic activity has been stronger than expected but we still expected it to continue to weaken over the course of this year. Business investment is expected to weaken somewhat further. The probability of recession in 2023 has risen significantly.

Consumers Remain Confident

The S&P 500 is up 17% year-to-date and the TSX 5% higher. (The rally since the recent mid-October 2022 low is more than 25% for the S&P 500 and 11% for the TSX). US consumer confidence has surged higher and investor sentiment is trending higher, economic growth is proving to be robust despite higher interest rates. Our valuation models, along with other market valuation measures show that markets are stretched with the S&P 500 index and most sectors in the overvalued range. However, we do want to point out that fundamentals can take a back seat to momentum and ‘stretch valuations can continue for an extended period. If the Fed does attach the ‘soft landing’ it is shooting for, and interest rates start to ease back without a recession then valuations will reset, and markets won’t ‘look as overvalued’. One unknown is the extent to which covid related policies will keep market buoyant for longer than otherwise. Our view is that the rapid rise in interest rates hasn’t fully worked through the economy and the combination of declining inflation rates and slowing growth will lead central banks’ decisions to lower interest rates later this year or early 2024.

Bearish comments in the news had our technical analyst consultant, Ron Meisels, asked “Why Is Everybody Bearish?” He points out that 2022 was the end of the 4-year cycle and Bullish signals appeared at the beginning of 2023 including: 1. There was a “Breath Thrust” signal in mid-January 2023, (there have only been 14 since 1945 and they have always signaled a bull market). 2. Up Volumes outnumbered Down Volumes on numerous days. 3. Twice as many stocks Advanced than Declined. 4. More than 400 stocks traded higher than their 52-week Moving Averages day-by-day. Ron forecasts that 2023 will be an “up-year” but does caution that equity market gains could slow down as the indices approach their all-time highs. He also reminds investors that September is generally a seasonally weak month for equity markets, but his view is that equity markets will rally again in October to finish 2023 as an “up-year” (Phases & Cycles).

Technical Picture for Gold

The gold market will be watching US economic data closely (if not also the data from Europe and Asia) to narrow in on when the Fed (and the ECB) will decide to cut rates.

Bonus Tip:

Capitalight Research provides you with insights into the Economy, Commodities and Equity markets!

Interested in subscription information - simply click below and fill in the form and I'll get back to you!

Peter Szydlowski

Director of Sales

We do the research, so you don't have to!

Comments